Tourism Jasper has serious concerns about the Municipality of Jasper’s proposed 2024 budget.

Representatives from the Destination Marketing Organization tabled a statement on the potential increases to Jasper’s tax requisition during the November 28 Committee of the Whole meeting.

“We feel we must speak up,” Tourism Jasper’s president and CEO, James Jackson, told councillors.

Jackson and two of his colleagues were presenting the organization’s Destination Stewardship Plan—a 10-year roadmap which aims to optimize and “future-proof” the region’s visitor economy.

After council endorsed the plan, Jackson used the time in front of local officials to express his organization’s concerns about a potential 16 percent increase in municipal taxes and the town’s possible encroachment on its debt limit.

“This level of spending is entirely unmaintainable,” Jackson said.

Last week, Jasper municipal administrators presented councillors with a $36 million draft budget with an increase of $1.3 million to the tax requisition. Proposed additions to the budget—mainly community organizations’ funding requests and staff positions—could increase that further by approximately $325K, a total potential increase of 16 percent over last year’s tax requisition.

“A 16 percent increase is extraordinarily high,” Jackson said.

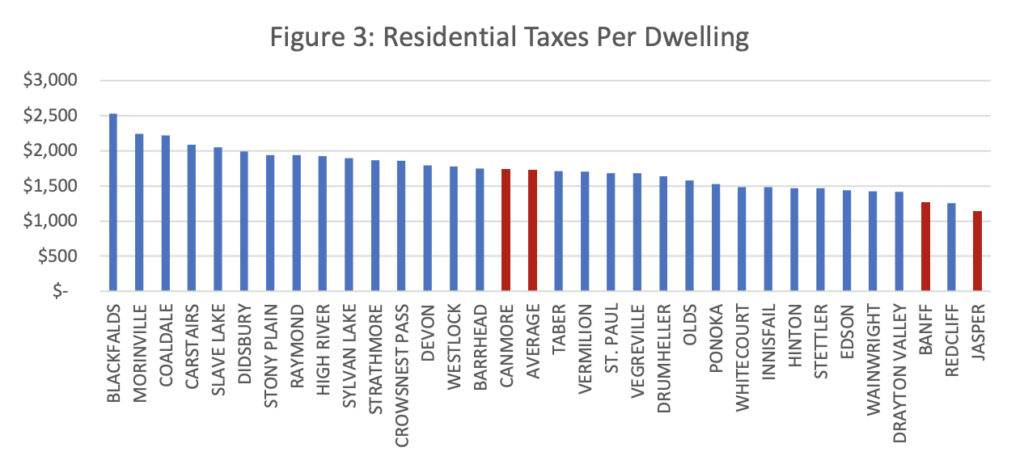

Jackson wants council to explore “all other revenue options” and quoted a 2022 report which detailed the costs and fiscal capacity of Banff, Jasper and Canmore to support their visitors. The Verum report, as it’s known, suggests that if Jasper were to bring residential property taxes per dwelling more in line with the average of 33 comparable communities, Jasper could generate approximately $1.1 million more tax dollars per year.

“We believe the municipality is leaving money on the table,” Jackson said.

But the strategy would amount to shifting the tax burden from commercial ratepayers to residential, Mayor Richard Ireland suggested. He said commercial ratepayers at least have the ability to recoup increased operational costs through their customers.

“Non-residential assessments are based on income. If income is increased, then the assessed value goes up. For residential assessments, the market value may be increasing, but that doesn’t mean any extra income is in the pockets of homeowners.” he said.

The Verum report points out that Jasper has the lowest residential property taxes per dwelling in the 33-comparable communities sample. It also notes Jasper has the second highest (after Banff) non-residential property taxes per business of the sample communities.

“The commercial sector is doing more than its fair share of municipal tax creation,” Jackson said.

Ireland asked for specific suggestions on how Tourism Jasper would cut unnecessary spending.

“If you can help us define unnecessary spending, that is exactly why we’re here,” he said.

More than $1 million of the draft budget’s $1.3 million increase to taxes are non-optional, including $600K in mortgage payments to pay for facility renovations; approximately $400K in staffing costs added last year; plus annual cost-of-living increases. Additionally, the requested $325K above that number is largely directed towards the non-profit sector.

“We need to enhance the capability of the non-profit sector to add value to the community,” Ireland said.

In advance of next week’s regular council meeting, CAO Bill Given encouraged councillors to suggest specific budgeting strategies and targets for which administration could bring information forward, to most productively utilize the group’s time.

In that vein, Councillor Ralph Melnyk made a motion for administration to prepare calculations to enable visitor paid parking revenues to procure an extra $150,000 (or 15 percent) in 2024. Administration will also come forward with concrete examples of what different tax increases will mean for different property owners.

Bob Covey // bob@thejasperlocal.com